NEWS FROM THE SF REAL ESTATE MARKET

Some facts you should take into consideration whether you're renting or planning to buy a rental property in San Francisco.

We asked Misha Weidman, SF real estate expert, to give us some figures and key facts that could influence you. It's still all about renting or buying in SF, the eternal question!

Here is what he answered us...

Being a renter is not a comfortable place to be these days. Chances are you’re either already paying astronomical rents or dreading the day that your landlord informs you of a major increase (except for rent controlled units).

In a “normal” market – and when is anything about SF “normal” – high rents push lots of people to buy their first homes. But with home prices so high, many are finding that they are stuck between two unappealing options. On the one hand, they can continue to fork over a lot of rent knowing they’ll see nothing for it at the end of the day. Or, if they’re lucky, they can find a modest home to buy in a neighborhood that’s a long way from being their top choice. If they’re unlucky, they’ve already been completely priced out by the run-up in home prices which, despite my January newsletter predictions, has re-ignited ferociously.

''the run-up in home prices ... has re-ignited ferociously.''

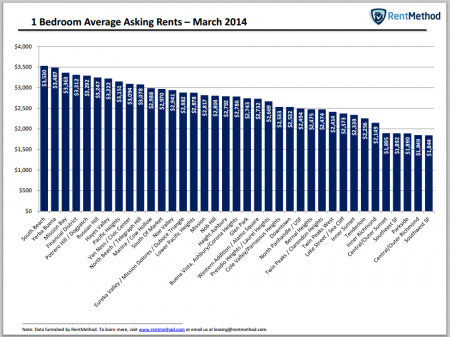

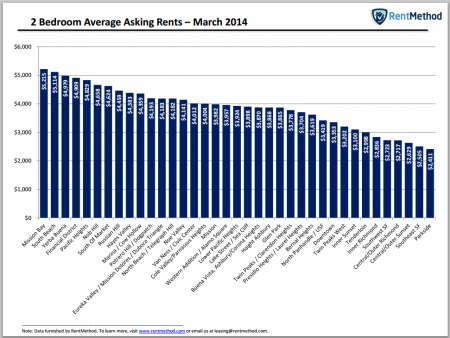

Rentmethod is a new residential leasing company that seeks to link landlords and tenants. Their website is pretty slick. They’ve provided me with some incredibly useful data which breaks down rental rates by neighborhood and number of bedrooms. Here are their charts on 1 and 2 bedroom units:

Where you find out that South Beach, Mission Bay and Yerba Buena are the most expensive neighborhoods to rent a 1br or 2 brs unit.

You won’t find these charts on their website, but you will find them, together with additional information on studios and longer-term trends, in their March Report available for download here.

Let's do some math...

Among the interesting things to consider: say you’re a techster living in a two bedroom apartment in Mission Dolores/Duboce, close to the tech-bus stops on Market Street. The average asking rent is $4183 per month. That same payment would support a 30 year fixed rate mortgage of $800,000 at a rate of 4.75% per annum. (An adjustable rate mortgage, with its lower initial rate, would support an even higher loan amount.) With a minimum down-payment of 20%, you could theoretically purchase a home that costs an even $1 million. Seems doable right? Financing is never that simple, but among the things that this analysis doesn’t take into account are property taxes and HOA dues covering insurance, maintenance and services, which, roughly speaking might add up to annual costs of around 2% of the purchase price. Those expenses alone would add $24,000 a year — $2,000 a month – to your expenses. And of course there’s the small problem of actually coming up with the $200,000 down-payment.

I’ve blogged in greater detail about the rent vs. buy here. And as recently as February, Trulia’s interactive heat map shows buying being “13% cheaper” than renting.

Now that's something to think about!

Courtesy of Misha Weidman, Paragon Real Estate Group.

You can follow the latest trends in the San Francisco real estate market, along with detailed analyses and charts, on Misha Weidman's blog at: www.RealDataSF.com.

Contact infos:

415-738 70 47

May 2014

Agenda

-

Movie releases, Festivals & DVDs

-

Theatre plays, Ballet, Opera

-

Jazz, Rock, Pop, Symphonic & Co

-

Museums and Art Galleries

-

For them... with them...

-

Games and sports events

-

If you have some spare time...